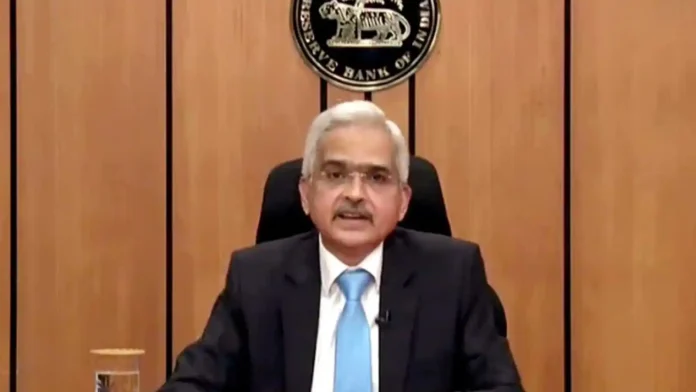

RBI Governor Meets with Bank MDs and CEOs

Reserve Bank of India (RBI) Governor Shaktikanta Das met with the managing directors (MDs) and chief executive officers (CEOs) of public sector banks (PSBs) and select private banks on Wednesday to discuss key issues, including the ongoing gap between credit and deposit growth, trends in unsecured lending, liquidity risk management, and asset-liability management issues, according to a release by the banking regulator.

Das emphasized the importance of enhancing governance standards, risk management practices, and the compliance culture within banks. He stressed the need for robust cybersecurity controls and effective management of third-party risks. Additionally, Das urged banks to intensify efforts against ‘mule accounts’ and to boost customer awareness and education initiatives to curb digital frauds.

The RBI Governor acknowledged the increased resilience and strength of the banking sector. He noted that the central bank had previously cautioned banks about the high credit-deposit growth gap and directed bank boards to re-strategize business plans. According to the latest RBI data, credit growth stands at 19.2 percent, while deposit growth is at 12.6 percent, indicating a 660 basis points (bps) gap. This figure includes the impact of the HDFC-HDFC Bank merger.

In November last year, the RBI increased risk weights for unsecured lending to moderate credit growth in this segment, following evidence of diluted underwriting standards and inadequate appraisals for unsecured credit. Consequently, growth in this segment has moderated to some extent.

During the meeting, the RBI management also discussed the increasing use of the rupee for cross-border transactions, credit flow to micro, small, and medium enterprises (MSMEs), and the participation of banks in the central bank’s innovation activities. Cybersecurity, third-party risks, and digital frauds were also key topics of discussion.

Das noted improvements in key banking metrics, such as asset quality, loan provisioning, capital adequacy, and profitability. These meetings with senior bank executives are part of the RBI’s continuous engagement with the senior management of its regulated entities, the central bank stated.

Deputy Governors M. Rajeshwar Rao and Swaminathan J, along with executive directors in charge of regulation and supervision functions, also attended the meetings.