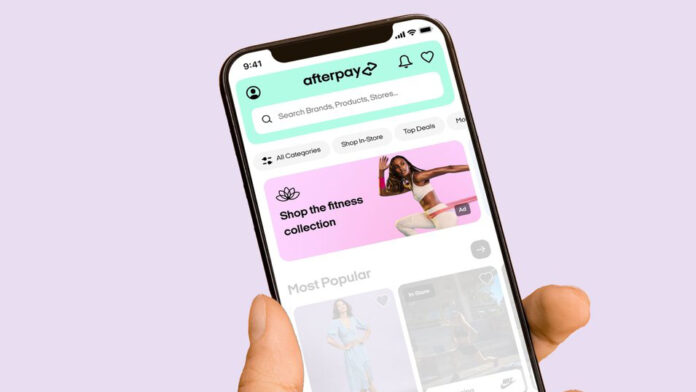

Today, Afterpay and Cash App, are excited to release the Future of Money white paper, a comprehensive report built on findings from a survey conducted with Morning Consult. This report dives into consumer spending behaviors, highlighting a clear shift toward fintech solutions and illustrating how BNPL encourages responsible financial habits amid changing landscapes.

How Fintech is Bridging the Gap in Consumer Finance

The Future of Money survey findings underscore a crucial trend: Fintech services are stepping in to meet the needs of consumers underserved by traditional banking. With approximately one-quarter of consumers having not utilized traditional checking nor savings accounts in the past year, it’s clear that many are seeking alternatives that offer greater convenience, speed, and transparency. Cash App, Afterpay, and similar Fintech services provide a refreshing alternative, addressing the unmet needs of consumers who value features like fast transfer speeds (42%), user-friendly interfaces (36%), and broad accessibility (33%).

The Growing Burden of Credit Card Debt

The survey also highlights a stark reality: credit card debt is a top financial burden for many consumers, ranking more common than mortgages, medical debt, and auto loans. For those struggling with debt, credit card balances weigh heavily on monthly expenses, creating a cycle that’s both financially draining and discouraging for many consumers. With 24% of respondents viewing the current credit system as unfair and 21% even labeling it invasive, the appetite for alternative, consumer-friendly solutions has never been stronger.

Younger Generations Trust Fintech

Fintech solutions resonate with financially savvy Gen Z and Millennial consumers who are turning to flexible, transparent options that align with their values. As revealed in the survey, approximately 1 in 10 Americans now use a BNPL service, and Afterpay remains a preferred choice thanks to its commitment to transparency and responsible lending.

Afterpay: A Flexible, Transparent Solution for Responsible Spending

Unlike credit cards, which often lock users into revolving debt with interest charges, Afterpay offers a structured alternative that supports financial health. Consumers can make purchases in installments, with clear payment schedules. Afterpay’s Pay-in-4 transactions are always interest-free when paid on-time, and longer-term loans avoid compounding interest—key advantages for consumers wary of high-cost debt. Among Afterpay users, there’s been a 30% year-over-year increase in Afterpay use since last year; this rises to 36% among individuals who are underbanked. This reflects Afterpay’s appeal to a broad range of consumers, including those without traditional bank accounts.

Afterpay’s real-time underwriting and frequent payment reminders further set it apart, helping consumers stay on track and avoid debt pitfalls. In contrast to traditional credit cards, Afterpay’s approach fosters responsible spending, allowing consumers to make informed choices and manage cash flow effectively.

A Glimpse into the Future of Money with Afterpay and Cash App

The Future of Money survey findings reflect a broader movement: consumers are redefining what they want from their financial services. Between Afterpay and Cash App’s commerce payment products, consumers are empowered with more choice at checkout outside of traditional banking and credit systems, providing a solution that combines the benefits of flexibility and security without the risks associated with traditional credit.

As more consumers choose Fintech over traditional financial institutions, Afterpay and Cash App are positioned to lead the way, empowering consumers with a transparent, responsible way to spend and manage their finances. The findings from this report underscore not just the growing demand for Fintech solutions but also the values that will shape the future of money: trust, transparency, and a commitment to financial wellness.