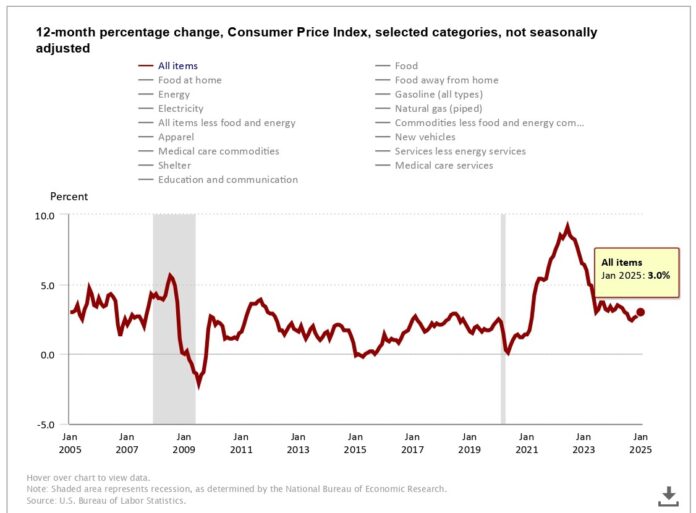

In January 2025, U.S. inflation saw an unexpected rise, with the annual rate increasing to 3% from December’s 2.9%, according to the Bureau of Labor Statistics. This marks the highest inflation level since June of the previous year.

The Consumer Price Index (CPI) climbed 0.5% for the month, driven by notable price hikes in shelter, food, and gasoline. Gasoline prices surged by 4.4%, accounting for over 40% of the monthly CPI increase.

Financial markets reacted negatively to rise in consumer prices report. The Dow Jones Industrial Average dropped 225 points (0.5%), while the S&P 500 fell 0.3%. Meanwhile, the yield on the 10-year Treasury note rose to 4.62% from 4.54%, signaling investor concerns about persistent inflation.

In response, President Trump blamed the Rise in consumer prices on the previous administration, labeling it “Bidenflation” and calling for immediate interest rate cuts. However, Federal Reserve Chairman Jerome Powell stressed that inflation remains a concern, making near-term rate cuts unlikely.

Economists caution that the administration’s recent tariffs on imports, especially from China, could further fuel inflation. As the Federal Reserve prepares for its March 18-19 meeting, it faces the challenge of managing inflation while supporting economic growth.

Apurva Sheth, Head of Market Perspectives & Research at SAMCO Securities, shared insights on U.S. CPI inflation:

TMT Fears Stoke US Inflation

US consumer price inflation (CPI) reading was higher than expected at 3%. This marks the fourth consecutive increase in CPI. Inflation is heating up because of three main reasons.

T – tariff wars: Trump’s tariff rhetoric has been pushing the prices higher. Some consumers have even started purchasing things like automobiles in advance fearing tariffs will lead to price hike in future.

M – mass deportation: Although only a few hundred have been deported yet. If the actual promise of ‘millions and millions’ of mass deportation were to be fulfilled then it will create massive shortage in the already heated labour market which will push up input costs.

T – tax cuts: Corporate tax cuts could also lead to more money supply pushing the prices higher.