Rating agency ICRA expects India’s edge data centre to expand significantly to 200-210 Megawatt (MW) by 2027 from 60-70 MW in 2024, marking a 3x increase, driven by proliferation of emerging technologies. Global data centre capacity (including capacity held by cloud operators) is estimated at around 50 Gigawatt (GW) as of December 2024, of which about 10% is edge data centres. The US commands over 44% of worldwide edge data centre capacity, followed by Europe, the Middle East and Africa (the EMEA) region at 32% and Asia Pacific (the APAC) region at 24%.

What is Edge Data Centre? – Edge data centres are smaller, decentralised facilities located closer to end-users and devices. Unlike traditional data centres, which are typically large and centralised, edge data centres enable real-time data processing with minimal latency (the delay between a user action and the corresponding system response). This makes them ideal for supporting emerging technologies such as the Internet of Things (IoT), 5G, augmented and virtual reality (AR/VR), and generative artificial intelligence (AI). These new age applications and technologies are forecasted to grow significantly in the medium term, resulting in an increased demand for edge data centres. |

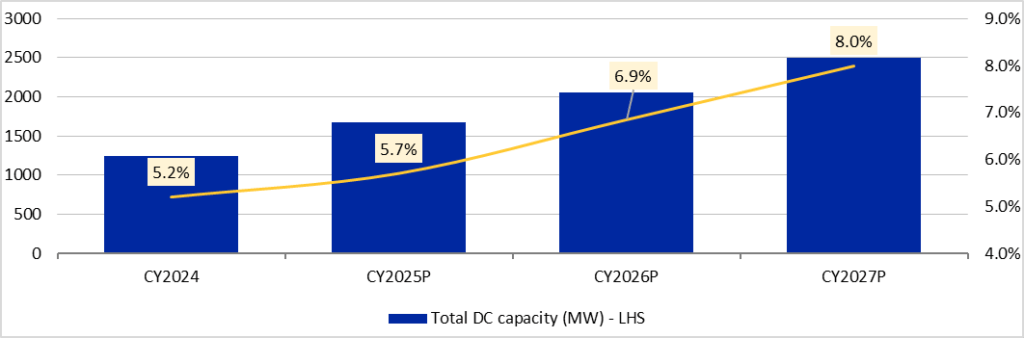

India is a relatively new entrant in the edge data centre market. The current edge data centre capacity as a percentage of total India’s data centre capacity stands at around 5%. Further, excluding the edge data centre capacity used for captive purposes by one of the large data centre operators, the current edge data centre capacity as a percentage of total capacity is as low as 1%.

Giving more insights, Anupama Reddy, Vice President and Co-Group Head, Corporate Ratings, ICRA, said:

“Edge data centres differ from traditional data centres in multiple parameters like size, location, scale, time taken to construct, capex cost per MW, distance from end user, etc. In the Indian context, traditional data centres and edge data centres are complementary pillars of digital infrastructure. With the expanding cloud ecosystem of India, traditional data centres will keep fuelling mass-scale computing, artificial intelligence (AI), and cloud workloads, and edge data centres will facilitate real-time processing and localised services. Traditional and edge data centers are expected to operate in the hub-and-spoke model to enhance efficiencies across sectors such as healthcare, banking, agriculture, Defence, and manufacturing etc.”

Despite the promising outlook, some of the key challenges for edge data centres include security vulnerabilities due to remote deployments (majorly in tier II and tier III cities), rapid technological changes that risk obsolescence, a shortage of skilled professionals in remote areas, and interoperability issues with traditional data centres.

“The rentals for edge data centres are anticipated to be on the higher side compared to traditional data centres, as they will be catering primarily to retail customers against enterprise/hyperscale customers for traditional data centres. Moreover, the relatively higher capex cost per MW for edge data centre compared to a traditional data centre is expected to be compensated by higher rentals. Established DC players and entities like RailTel, Telcom operators are likely to lead the edge data centre expansion in India,” Reddy added.

EXHIBIT 1: GROWTH IN INDIA’S EDGE DATA CENTER CAPACITY AS A % OF OVERALL DC CAPACITY

Source: ICRA Research; P-Projected