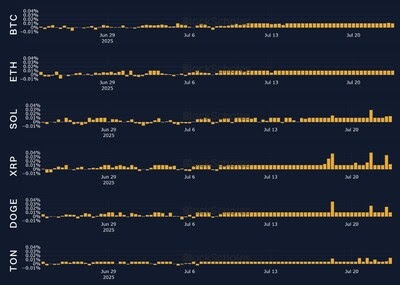

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest crypto derivatives analytics report with Block Scholes, diving into a momentous “Crypto Week” in bullish territories. Crypto’s total market cap exceeded $4 trillion for the first time, driven by a combination of legislative advancements in the US and investor enthusiasm from BTC to altcoins.

Key Insights: Altcoins Regained Favor: Following BTC’s initial surge, traders’ growing risk appetite started to spill over to altcoins. With ETH and SOL breaking barrier levels in the decisive week, widespread gains across the altcoin space uplifted the total crypto market cap to a historic high.

This altcoin rally contributed to BTC dominance falling below 60% as investors diversified across the digital asset spectrum. ETH Calls Over Puts: ETH options trading has become heavily skewed toward bullish positions, with call options dominating both volume and open interest metrics. The volatility term structure has compressed to a tight 64-65% range, while call skew peaked at 11%, reflecting strong directional conviction among institutional traders.

ETH Funding Rates Are Remarkably Strong: ETH spot price had more than doubled since its $1,500 level in April, bolstered by consistent positive inflows to ETH Spot ETFs and rising corporate interest in building ETH treasuries. ETH funding rates follow the broader positive trend of the market