Bitfarms Ltd., a global vertically integrated Bitcoin data center company, reported its financial results for the fourth quarter ended December 31, 2024. All financial references are in U.S. dollars.

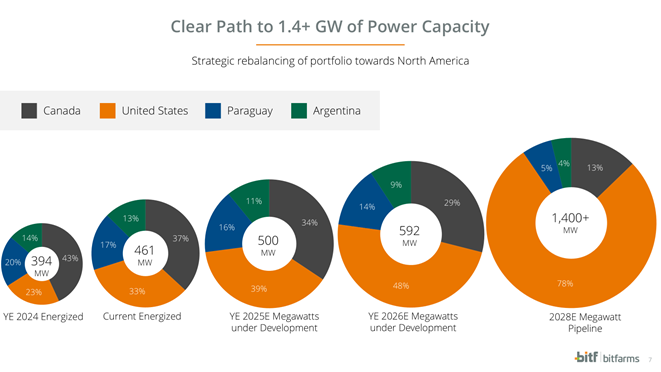

CEO Ben Gagnon stated, “Bitfarms is a completely different company than we were at the beginning of 2024. Across nearly every metric, we have rapidly transformed from the international Bitcoin miner to a North American energy and compute company. We now have one of the largest portfolios of flexible MW in the PJM market among Bitcoin miners and are well-positioned to capitalize on macro tailwinds and surging demand for U.S. power and infrastructure. From January 2024, we’ve grown our energized capacity over 90% to 461 MW and secured a multi-year pipeline of over 1.4 GW, nearly 80% of which is based in the U.S and over 90% of which is based in North America.

“Just last week, we closed both the transformative acquisition of Stronghold Digital Mining, the largest M&A deal between two public miners in our industry, and the strategic sale of our 200 MW Yguazu data center, our largest constructed site. Thus far this quarter, we advanced our HPC/AI strategy with the engagement of two new advisors, hired two new critical team members, an SVP of HPC and an SVP of Infrastructure, and significantly improved our hashrate, reaching 18.6 EHuM, which we expect will generate operating cash flow through 2026 and beyond.

“While we remain confident in the significant upside potential of Bitfarms,s BTC mining operations and continue to maximize the value of our assets, our revenue diversification strategy—both in the U.S. and with HPC/AI—is geared toward driving greater shareholder value. We aim to secure long-term, predictable cash flows from a well-capitalized HPC/AI customer, while diversifying our revenue streams, reducing our dependency on BTC price volatility, and capitalizing on the growing demand for AI computing. Our two recent strategic transactions, the Stronghold acquisition and the Yguazu data center sale, demonstrate execution of this strategy,” concluded Mr. Gagnon.

SVP of Mining Operations Alex Brammer stated, “We’ve made significant progress with our mining operations over the past year, nearly tripling our hashrate and improving our efficiency by over 40%. This momentum continues to accelerate. In the last three months alone, we grew our hashrate over 40% to 18.6 EH/s and reached our first half efficiency target of 19 w/TH three months ahead of schedule. This was achieved through the energization of two North American sites, new miner deliveries and continued optimizations across all of our sites.”

CFO Jeff Lucas stated, “The recent acquisition of Stronghold and sale of Yguazu have expanded our growth opportunities and strengthened our financial profile. Our identified capex requirements for 2025 are now 20% lower than previously planned and we have no plans for large miner purchases in 2025 or 2026; instead, we will be deploying this capital towards developing U.S. energy and HPC infrastructure. We expect that this shift in our strategy will enable us to raise capital more cost-effectively and to secure steadier earnings streams and greater operating margins, the culmination of which we expect will drive long-term shareholder value.”

Anticipated Megawatt Growth

Mining Operations

- Current hashrate of 18.6 EHuM, up from 6.5 EHuM in Q4 2023

- Current efficiency of 19 w/TH, a 45% improvement from Q4 2023

Recent Strategic Developments

- Completed previously announced acquisition of Stronghold Digital Mining, Inc.

- Completed previously announced sale of 200 MW data center in Yguazu, Paraguay to HIVE Digital Technologies

- Secured two strategic partners, ASG and World Wide Technology, to advance HPC/AI business

- Strengthened Management team with two new strategic hires, James Bond, SVP of HPC/AI, and Craig Hibbard, SVP of Infrastructure

- Initiated Bitcoin One program following the success of Synthetic HODL program in 2024, which achieved a 135% return since the program’s inception in Q4 2023 through December 31, 2024.

Q4 2024 Financial Highlights

- Total revenue of $56 million, up 21% Y/Y

- Gross mining margin of 47%, down from 57% in Q4 2023

- General and administrative expenses of $18 million, compared to $13 million in Q4 2023

- Operating loss of $16 million compared to an operating loss of $13 million in Q4 2023

- Net income of $15 million, or $0.03 per basic and diluted share compared to a net loss of $62 million or $0.21 per basic and diluted share in Q4 2023

- Adjusted EBITDA* of $14 million, or 25% of revenue, down from $16 million or 35% of revenue in Q4 2023

- Bitfarms earned 654 BTC at an average direct cost of production per BTC* of $40,800

- Total cash cost of production per BTC* was $60,800 in Q4 2024

Liquidity**

As of March 26, 2025, Bitfarms had total liquidity of approximately $135 million.

Q4 2024 and Recent Financing Activities

- Sold 502 BTC at an average price of $81,400 for total proceeds of $41 million in Q4 2024 and sold 117 of the 414 BTC earned during January and February 2025, generating total proceeds of $11 million. A portion of the funds was used to pay capital expenditures to support Bitfarms’s growth and efficiency improvement objectives.

- As of March 26, 2025, Bitfarms held 1,093 Bitcoin.

- Raised $50 million in net proceeds during Q4 2024 bringing the total net proceeds to $314 million through March 26, 2025 under the Company’s 2024 at-the-market equity offering program.

| Quarterly Operating Performance | |||

| Q4 2024 | Q3 2024 | Q4 2023 | |

| Total BTC earned | 654 | 703 | 1,236 |

| Average Watts/Average TH efficiency*** | 22 | 23 | 35 |

| BTC sold | 502 | 461 | 1,135 |

| As of December 31, | As of September 30, | As of December 31, | |

| 2024 | 2024 | 2023 | |

| Operating EH/s | 12.8 | 11.3 | 6.5 |

| Operating capacity (MW) | 394 | 310 | 240 |

| Quarterly Average Revenue**** and Cost of Production per BTC* | ||||||||||

| Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | ||||||

| Avg. Rev****/BTC | $82,400 | $60,900 | $65,800 | $52,400 | $36,400 | |||||

| Direct Cost*/BTC | $40,800 | $36,600 | $30,600 | $18,400 | $14,400 | |||||

| Total Cash Cost*/BTC | $60,800 | $53,700 | $47,600 | $27,900 | $23,300 | |||||

* Gross mining profit, gross mining margin, EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Direct Cost per BTC and Total Cash Cost per BTC are non-IFRS financial measures or ratios and should be read in conjunction with, and should not be viewed as alternatives to or replacements of measures of operating results and liquidity presented in accordance with IFRS. Readers are referred to the reconciliations of non-IFRS measures included in the Company’s MD&A and at the end of this press release.

** Liquidity represents cash and balance of unrestricted digital assets.

*** Average watts represent the energy consumption of miners.