TeraWulf Inc. a leading owner and operator of vertically integrated, next-generation digital infrastructure powered by predominantly zero-carbon energy, today completed its previously announced offering of 2.75% Convertible Senior Notes due 2030 (the “Convertible Notes”) in a private placement to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The aggregate principal amount of notes sold in the offering was $500 million, which includes $75 million aggregate principal amount of notes issued pursuant to an option to purchase additional notes granted to the initial purchasers.

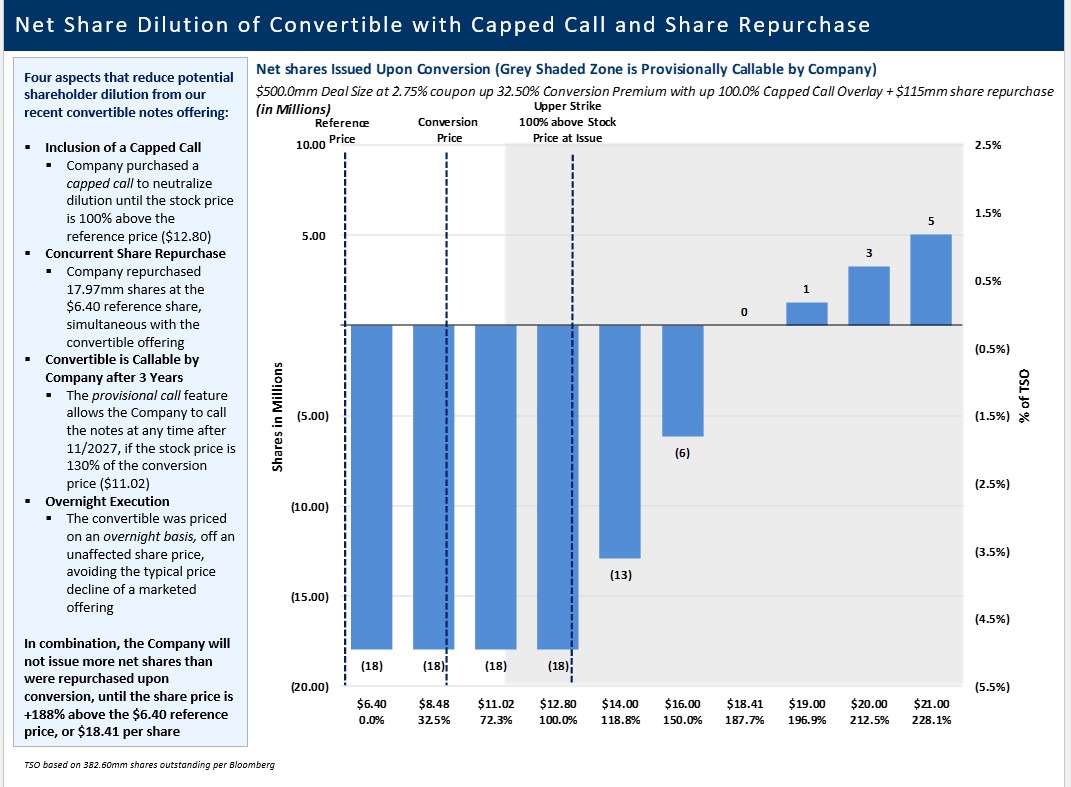

In conjunction with the issuance of the Convertible Notes, TeraWulf Inc entered into capped call transactions with a cap price of $12.80 (representing a premium of 100% over the last reported sale price) and repurchased $115 million of the Company’s common stock.

The table below illustrates the potential net dilution expectations from the overall transaction.

The net proceeds from the sale of the Convertible Notes were approximately $487.1 million after deducting the initial purchasers’ discounts and commissions and estimated offering expenses payable by tTeraWulf Inc. TeraWulf Inc expects to use $60 million of the net proceeds to pay the cost of the capped call transactions, $115 million to repurchase shares of its common stock and the remainder for general corporate purposes, which may include working capital, strategic acquisitions, expansion of data center infrastructure to support high-performance computing activities and expansion of existing assets.