AMFI data shows mutual fund recorded nearly almost 40k crore of inflows for month of Jan 25 where we have seen broader indices corrected more than 12% from its peak. There was a slight dip of 3.6% in inflows compared to December 2024, but we’re still seeing positive flows for the 47th month in a row. This small drop came after a pullback in both the NSE and BSE indices.

Commention on data Mr. Viraj Gandhi, CEO of Samco Mutual Fund said:

Prudent or not time shall tell, but resilient for sure. MF inflows for month of Jan 2025

However, the markets experienced intermittent bouts of volatility, driven by sluggish economic growth, rising protectionist tendencies, and geopolitical uncertainties. These factors contributed to market jitters over the past few months. Despite these hurdles, the steadfast commitment of domestic investors through SIPs underscored a deeper confidence in the long-term potential of the Indian economy. This resilience not only cushioned the impact of external shocks but also painted a promising picture of the future, where domestic participation is seen strengthening the foundation of India’s financial markets.

Small cap index corrected by more than 13% from its peak but there is no slowdown in inflows from this segment. To everybody’s surprise Jan25 saw a record inflow of Rs 5721 crores a stellar growth of 23% QoQ and 75% YoY in a correcting phase.

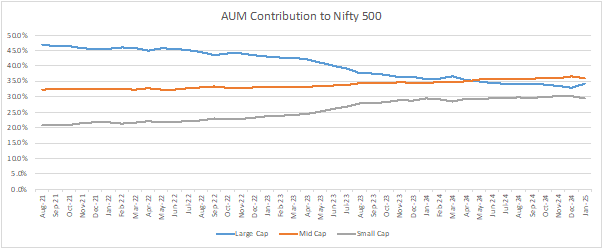

The contribution of Nifty 100 (large cap schemes) to Nifty 500 kept falling from 47% in Aug 21 to 33% in Dec 24 and we saw the first upsurge in this ratio to 34.3% in this month. This was aided by relatively lesser fall in frontline index compared to mid and small cap index and also due to inflow of Rs 3000 crore in Jan25.

The steep rise of small cap AUM to Nifty 500 from 21% in Aug 21 to 30% in Dec 24 has cooled down for first time to 29.6% despite record inflow of 5721 crores due to steep correction in small cap index from recent highs.

Very interesting market reaction to shining metals. Despite the soaring prices of bullion (gold and silver), the inflows to multi asset allocation saw 17 month low inflow of Rs 2123 crores, which was expected to be on higher side.