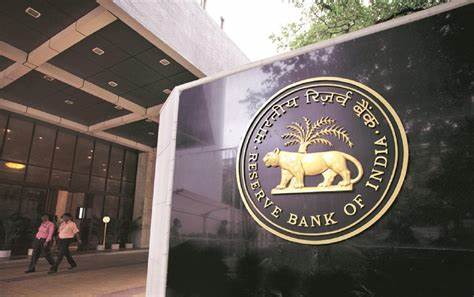

RBI Tightens Grip on ECL Finance, Edelweiss ARC

Continuing its oversight of banks and other financial institutions, the Reserve Bank of India (RBI) announced on Wednesday its prohibition of Edelweiss Asset Reconstruction Company (EARCL) from acquiring financial assets. Additionally, ECL Finance was instructed to refrain from engaging in structured transactions for its wholesale exposures.

These measures were prompted by misconduct among group entities, which were involved in a series of transactions aimed at perpetuating stressed exposures of ECL Finance through the EARCL platform and associated alternative investment funds (AIFs). The head Bank, in a released statement, highlighted that these transactions were bypassing applicable regulations. Similar measures had previously been taken by the RBI against JM Financial Products and IIFL Finance.

The RBI also found discrepancies in the valuation of security receipts (SRs) for both ECL and EARCL. Furthermore, ECL was found to have engaged in various improper practices, including providing incorrect details of eligible book debts to lenders for computing drawing power and non-compliance with loan-to-value norms for lending against shares.

Instances of incorrect reporting to the Central Repository for Information on Large Credits (CRILC) system were also noted by the central bank. Additionally, the entities were found to have not adhered to the know your customer (KYC) guidelines set by ECL.

The RBI criticized ECL for allowing loans from non-lender entities of the group to be sold to the group’s ARC, thereby circumventing regulations that only permit ARCs to acquire financial assets from banks and financial institutions.

Regarding EARCL, violations included failure to present the RBI’s supervisory letter issued after the previous inspection and non-compliance with regulations related to loan settlements and sharing of non-public client information with group entities.

The RBI expressed concerns over the use of AIFs to perpetuate loans and directed financiers to increase provisions or allocate more funds for such investments.

Earlier this month, Kotak Mahindra Bank faced restrictions on new customer acquisition through online and mobile banking channels, as well as issuing fresh credit cards, due to IT system deficiencies. Similar restrictions were imposed on Bank of Baroda and Paytm Payments Bank.

The RBI directed both EARCL and ECL to enhance their assurance functions to ensure regulatory compliance effectively and immediately. These actions are effective immediately, according to the RBI statement.