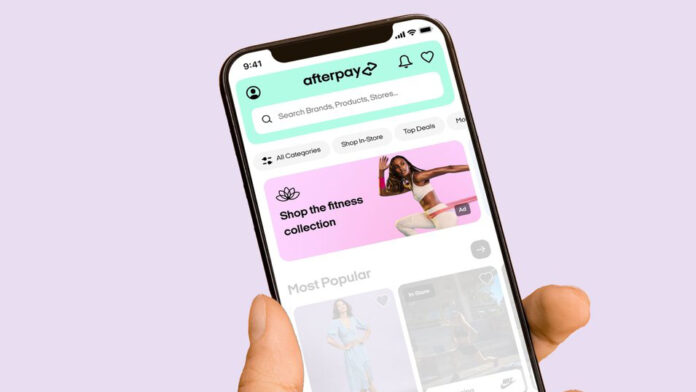

Afterpay Research Highlights $127 Million Savings for Australians in 2023

Afterpay today released new research conducted by Mandala, showcasing the significant economic impact of Australia’s leading Buy Now Pay Later (BNPL) provider on its 3.5 million active customers and 129,000 merchants across the country.

The independent report reveals that in 2023, customers saved $127 million in consumer fees and interest compared to using credit cards, while Afterpay merchants realized $5 billion in net benefits from increased sales and cost efficiencies.

“As Australians look to make their money go further, Afterpay offers a flexible and transparent tool to manage their spending and a much better alternative than relying on high-interest credit cards,” said Katrina Konstas, EVP and country manager for Afterpay APAC. “This research shows that Afterpay is reducing the financial stress of Australians, millions of whom are voting with their feet by choosing a reliable, low-cost, and easy-to-understand payment method like Afterpay.”

The report highlights the following benefits for the company customers in 2023:

– Paid less than 0.6% of purchase value in late fees, significantly lower than credit card fees, which average 1.5%

– 61% of customers stated Afterpay is their preferred consumer finance option

– 54% reported it reduces the stress of large expenses

– 40% said it helps them avoid high-interest credit card debt

– Over one-third said they use their credit card less or have replaced their credit card with BNPL, and an additional 22% don’t use a credit card at all

From a merchant perspective, the company delivered substantial benefits:

– $5 billion in benefits from increased sales and cost efficiencies

– 65% of merchants reported exposure to new customers

– 123,000 small and medium-sized businesses have used the platform

– $13.4 billion in total sales generated through the company channels

“Australians who use BNPL are significantly less likely to own credit cards, which represents a notable shift in consumer behavior,” said Amit Singh, Managing Partner at Mandala. “The research indicates BNPL is favored by households because it allows large expenses to be spread across multiple paychecks without dipping into savings. This is a different model of household income management compared to traditional credit cards.”

A copy of the full Afterpay Economic Impact in Australia report, including additional information on the company’s contribution to GDP, can be found here.

Afterpay is transforming the way we pay by allowing customers to buy products immediately and pay over time – enabling simple, transparent and responsible spending. We are on a mission to power an economy in which everyone wins. The company is offered by thousands of the world’s favourite retailers and used by millions of active global customers. The company is currently available in Australia, Canada, New Zealand, the United States and the United Kingdom, where it is known as Clearpay. Afterpay is a wholly owned subsidiary of Block, Inc.