AUM Crosses ₹1.14 Lakh Crore Mark as Pre-Provisioning Operating Profit Jumps 23.2%; Company Fortifies Balance Sheet with Labour Code & NPA Provisions

Leading financial services group HDB Financial Services, a subsidiary of HDFC Bank Limited today announced robust financial results for the third quarter ended December 31, 2025, demonstrating a powerful combination of high growth, improved profitability, and strategic, forward-looking provisioning.

HDB Financial Services reported a 36.3% year-on-year surge in quarterly Profit After Tax (PAT) to ₹644 crore, up from ₹472 crore in Q3FY25. This was propelled by a significant 34.3% increase in Profit Before Tax (PBT) to ₹860 crore.

Core Operating Performance Shines

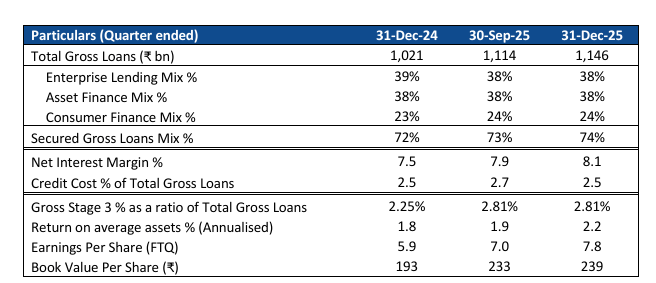

The underlying business momentum remained strong. Assets Under Management (AUM) grew by 12.0% to ₹1,14,853 crore, while Gross Loans saw a similar expansion of 12.2% to ₹1,14,577 crore. The core revenue engine fired on all cylinders, with Net Interest Income (NII) growing 22.1% to ₹2,285 crore and Net Total Income rising 18.8% to ₹2,970 crore. This operational strength was reflected in the Pre-Provisioning Operating Profit (PPOP), which jumped 23.2% to ₹1,573 crore.

Prudent & Proactive Provisions Strengthen Foundation

Demonstrating a conservative and responsible approach,HDB Financial Services proactively made provisions for future contingencies. The Employee Benefit Expense for the quarter includes a one-time provision of ₹61 crore related to the implementation of new labour codes, with ₹56 crore pertaining to the lending business.

Simultaneously, the company increased its provisions for loan losses to ₹712 crore (up 12% YoY), building a stronger buffer. While asset quality metrics saw some movement in line with broader economic trends—with Gross Stage 3 (GNPA) at 2.81% and Net Stage 3 (NNPA) at 1.25%—the company’s provision coverage on Stage 3 assets remains substantial at 55.59%.

Nine-Month Snapshot

For the nine months ended December 31, 2025,HDB Financial Services recorded a PAT of ₹1,793 crore, marking a 9.0% growth over the corresponding period last year (₹1,645 crore).