Recent reports indicate that India’s Nifty 50 index may be poised for a rebound next week. Derivatives data suggests a potential relief rally, with an increased rollover of Nifty futures into February, reflecting trader confidence and possible market stabilization.

Despite these positive signals, the broader trend remains bearish, prompting experts to urge caution. Over the past four months, the Nifty 50 has declined by 11.3%, marking its longest losing streak in 23 years.

Given these conflicting indicators, investors should stay vigilant, closely track market movements, and weigh both the optimistic and bearish trends before making investment decisions.

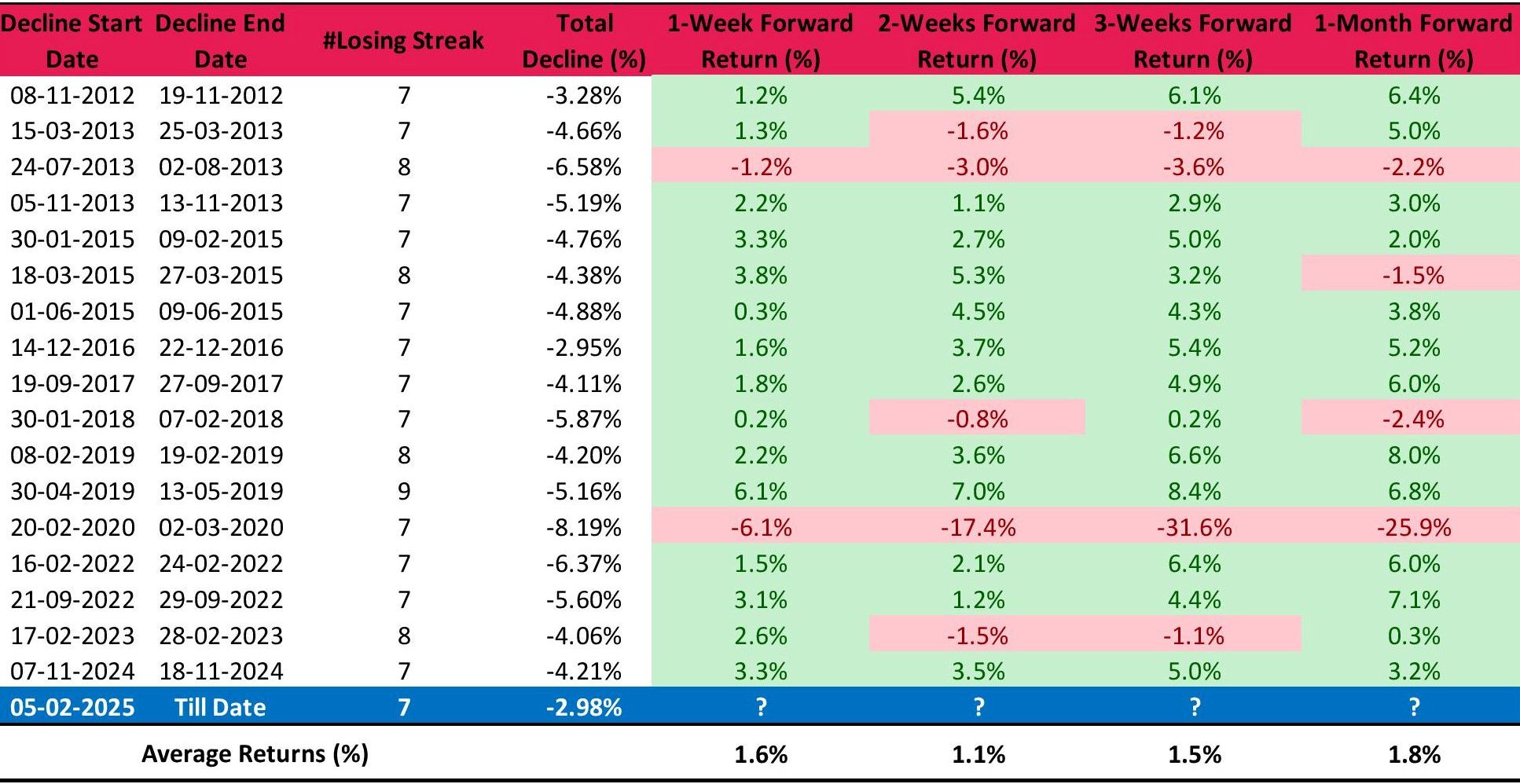

This table analyzes Nifty 50’s past losing streaks and subsequent forward returns. It captures instances where Nifty 50 experienced a continuous losing streak of at least seven trading sessions and evaluates how the index performed in the weeks following such declines.

The data spans from 2012 to 2025, providing insights into market behavior after extended downturns. Historically, after a prolonged losing streak, Nifty 50 tends to recover in the following weeks. The average 1-week forward return is 1.6%, indicating a short-term rebound.

Larger declines, such as the -8.19% drop in March 2020, led to extended weakness, with Nifty falling -6.1% in the subsequent week and -31.6% over three weeks. However, most other corrections resulted in a positive return in the following weeks.

As of 13-Feb-2025, Nifty 50 has undergone a 7-day declining streak with a cumulative fall of -2.98%. Based on historical patterns, the index may have a probability of rebounding over the next few weeks.