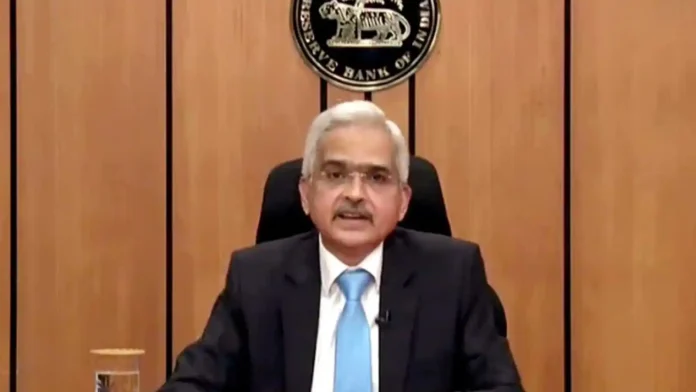

RBI MPC update:

Today, the Reserve bank of India MPC press conference was held, and the RBI Governor, Mr. Shaktikanta Das, briefed the public about the MPC’s decisions. Here are some key highlights:

1. Repo Rate: Remains unchanged at 6.50%.

2. Food Inflation: Continues to be a concern.

3. Inflation Target: The RBI aims to keep inflation under 4%.

4. Global Economic Stability: Improvements are being observed globally.

5. Global Inflation: Inflation rates are declining worldwide.

6. Monsoon:The monsoon is normal, benefiting the Kharif crop.

7. Domestic Growth:Domestic growth is moving in a positive direction.

8. Sector Strength: Both the service and manufacturing sectors are showing strong performance.

9. GDP Growth Forecast: The GDP growth forecast for FY25 has been revised down from 7.5% to 7.2%.

10. Q3 FY25 GDP Growth: The GDP growth rate for the third quarter of FY25 is maintained at 7.3%.

The first comment we recieved from Anil Gupta, Senior Vice Presidentc Co Group Head – Financial Sector Ratings, ICRA Ltd on post MPC.

On the increased frequency of reporting Credit Information to Credit Information Companies he says-

“Given the ease of credit availability through digital processes, the leveraging and the credit profile of the borrowers can change quickly and faster reporting by lenders to credit bureaus will help in improved decision making by the lenders.”

Mr Gupta further comment on the need to raise retail deposits by banks:

“Deposit rates may continue to remain high, given the regulatory nudge to increase focus on the retail deposits while pursuing credit growth. Recent regulatory action on tightening liquidity coverage ratio regulations and concerns on credit growth outpacing deposit growth points towards likely slowdown in credit growth in near term. ICRA expects the credit growth to slow down to 11.6-12.5% in FY2025 from 16.30% in FY2024.”

He added On the top-up loans:

“With increased activity levels in the top-up loan segment, RBI’s caution to lenders on calibrating underwriting norms and closer monitoring of the end-use is a step in the right direction. Such loans not only raises concerns on overleveraging but, it also raises suspicion on the quality of such borrowers, as they may also use such top-up loans to service the existing loans.”