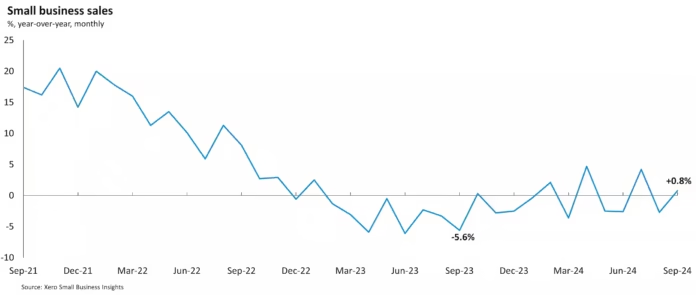

Xero, the global small business platform, today released its latest data on small business sales and payment times that showed overall performance improved for small businesses in the September 2024 quarter. For the first time since late 2022, sales growth was positive and late payments and time to be paid metrics both had shorter waiting times.

These trends were identified as part of Xero Small Business Insights (XSBI), which uses aggregated and anonymized data from tens of thousands of Xero small business subscribers in North America covering the past seven years (January 2017 through September 2024). XSBI also tracks sales and time to be paid for four of the US Census Bureau’s major regions (West, Midwest, Northeast and South) to showcase the differing experiences of small businesses in each region.

September quarter at a glance:

- Small business sales rose an average of 0.8% year-over-year (y/y) in the three months to September, following a 0.1% fall in the June quarter

- Small businesses were paid an average of 9.1 days late in the September quarter, which is 0.5 days shorter than the June quarter result

- Small businesses waited an average of 28.7 days to be paid in the September quarter, 0.7 days shorter than the June quarter. This metric has been generally stable, between 28.5 days and 29.5 days, since early 2023

Regional results highlight different experiences across the US

All major regions recorded positive sales growth in the September quarter. This was led by the Northeast (+1.3% y/y), followed by West (+0.8% y/y), South (+0.6% y/y) and Midwest (+0.2% y/y). The most consistent region over 2024 so far has been the West, which has now recorded three consecutive quarters of sales growth.

However, the average time small businesses waited to be paid in the major regions saw more variety:

- Improvements in average time to be paid: The South (down 1.8 days to 28.5 days) and the Midwest (down 0.3 days to 30.0 days)

- Longer payment times: The Northeast (up 1.3 days to 29.0 days) and West (up 0.5 days to 28.2 days)

“It’s encouraging to see US small businesses trending in a positive direction after nearly two years of challenging conditions,” said Louise Southall, Economist at Xero. “Positive sales growth and shorter payment times in the September quarter are promising indicators that economic pressures are easing. To maintain healthy cash flow and build resilience against any future economic uncertainties, small businesses should prioritize strategies that encourage their customers to pay promptly.”

Small business landscape in 2025

A Xero survey in November 2024 found 88% of US respondents felt positive, more positive or much more positive about their businesses’ future than they did in the previous month.¹ This optimism was the highest among the countries included in this survey (Australia, Canada, New Zealand and the UK). This indicates that many US small businesses entered 2025 with a strong sense of confidence.

Compared to early 2024, small businesses are benefitting from lower inflation and a more favorable interest rate environment, supported by the Federal Reserve’s decision to cut its Federal Funds target multiple times since September 2024. These changes, along with lower inflation, are expected to ease some of the pressure on profits and cash flow that businesses faced over the past several years.

“Unfortunately, the US government’s decision to levy tariffs on Canadian goods, and the subsequent retaliatory measures, have likely dented this growing optimism. Small businesses and their customers on both sides of the US-Canadian border will pay more for goods that travel across this border, impacting the often intertwined supply-chains and adding to the cost of business operations,” added Southall.

“While the new administration has promised economic policy changes that will impact the business landscape, small businesses must also contend with ongoing economic challenges like cash flow disruptions and late payments,” commented Michael Cascone, Vice President of Government Experience, Americas at Xero. “To remain agile and adapt to new policies and economic shifts that impact their long-term success, small businesses should prioritize financial resilience—through strategic planning, operational efficiency, and proactive cash flow management.”