Money Management: Mastering your Finance

Introduction: Money Management

Effective money management is a fundamental skill that empowers individuals to take control of their financial destinies. Whether you’re aiming to build wealth, pay off debt, or achieve financial freedom, adopting sound money management practices is essential. In this blog post, we’ll explore key principles and strategies for mastering your finances.

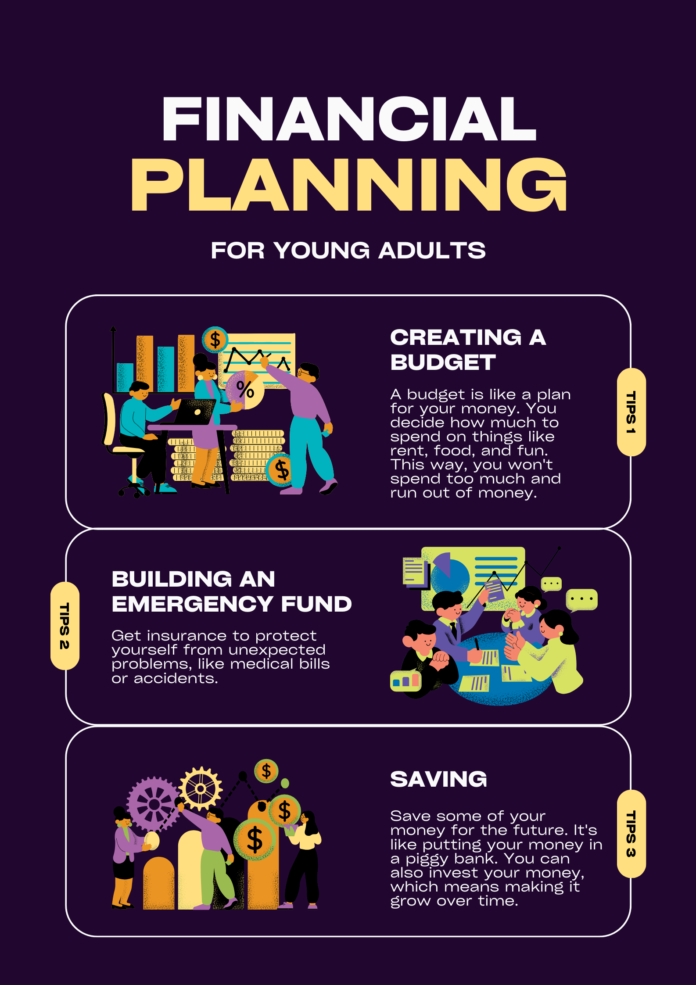

- Create a Budget: The cornerstone of effective money management is a well-structured budget. Start by listing your monthly income and expenses. Categorize expenses into fixed (mortgage, utilities) and variable (entertainment, dining out). This helps you gain a clear understanding of where your money is going and enables you to allocate funds strategically.

- Emergency Fund: Building an emergency fund is a crucial step in financial planning. Aim to set aside three to six months’ worth of living expenses in a liquid, easily accessible account. This fund acts as a safety net during unforeseen circumstances, preventing you from going into debt in times of need.

- Debt Management: Identify and prioritize high-interest debts for repayment. Utilize strategies like the debt snowball or debt avalanche methods. Paying off debts systematically not only saves money on interest but also provides a psychological boost as you witness progress in your financial journey.

- Savings and Investments: Cultivate a habit of regular saving. Whether through employer-sponsored retirement plans, individual retirement accounts (IRAs), or other investment vehicles, saving for the future is crucial. Diversify your investments based on your risk tolerance and financial goals to maximize potential returns.

- Smart Spending: Adopting mindful spending habits is integral to money management. Differentiate between needs and wants, and prioritize essential expenditures. Consider embracing the 50/30/20 rule, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Financial Education: Stay informed about personal finance concepts and investment strategies. Attend workshops, read financial literature, and leverage online resources to enhance your financial literacy. A well-informed individual is better equipped to make sound financial decisions.

- Regular Review: Money management is an ongoing process. Regularly review your budget, track your spending, and reassess your financial goals. Adjust your strategies as your circumstances evolve to ensure that your money management approach remains effective.

Conclusion:

Mastering money management is not a one-time task but a continuous journey. By creating a realistic budget, establishing emergency funds, managing debt wisely, and making informed investment decisions, you pave the way for financial success. The key is to be proactive, stay disciplined, and adapt your strategies as needed. With a solid money management foundation, you’ll be well-positioned to achieve your financial aspirations and navigate life’s financial challenges with confidence.